Savills reports on Jakarta’s new developments, apartments and foreign investment

Contact

Savills reports on Jakarta’s new developments, apartments and foreign investment

First-home buyers, investors, and developers seek quality and affordability in residential investment in Jakarta, according to Savills Asian Cities Report, Jakarta Residential 2H 2017.

Savills, in their Asian Cities Report, Jakarta Residential 2H 2017, reports Jakarta prides itself on being the nation’s main commercial, political and business hub, and has even historically maintained growth rate figures higher than Indonesia. Its annual GDP growth rate for the second quarter of 2017 sat at 5.96%, outperforming Indonesia’s result of 5.01%.

At a glance:

- 30,000 units are expected to be completed by 2018

- Prices will remain under pressure until 2019

- Urban sprawl and inclination to own landed houses has extended housing developments to the outskirts

- Growing competition has exerted downward pressure on apartment prices

- To spur the first-home buyer’s market, the Bank of Indonesia reduced down payments to 15% of the price, from 20%

New developments

Savills expects the level of stock completion to remain high in 2018, with almost 30,000 units in Jakarta due to complete by then. Prices will consequently remain under pressure in this period, before the market finally catches its breath in 2019.

There are only about 8,400 units due to complete in 2019, and this is expected to increase about 4% to 8% per annum between the 2019 and 2021 period.

New developments in Jakarta over the past decade have been dominated by high density vertical housing (i.e. apartments). In the beginning, this trend presented a challenge, as many Jakartans were still inclined to live in landed houses, a tradition prevalent throughout nation. Consequently, the city underwent an urban sprawl where housing developments were extended into the outskirts of Jakarta, an area collectively called as Bodetabek.

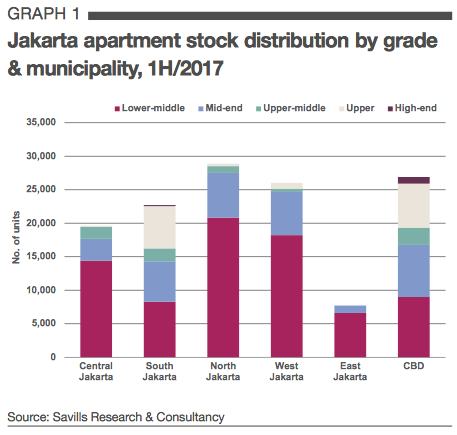

Currently, there are approximately 131,900 apartment units in Jakarta, a tiny fraction compared to the city’s population of 10 million – or 30 million together with the Bodetabek area.

Apartments

The apartment market in Jakarta went through a cyclical upswing in the early 2000s, where the first wave of new developments began to flood the market. This trend grew until 2015, where developers took advantage of the ‘back to the city’ living concept. As a result of robust launches during that period, the level of newly-completed supply in the past few years has been high. This level is expected to peak in 2017, with 34,071 units to complete by this year, a substantial difference to the average number of units completed in the past 5 years, which was 9,718 units. There is growing competition in the market which has continued to exert downward pressure on apartment prices, as demand remains soft. All of the grades are facing price corrections, with the lower-middle grade experiencing the largest decline. As a measure to invigorate demand, many developers have had to offer discounts, incentives and even a lower price to start with.

Accommodative policies

The government has also intervened through the introduction of accommodative tax and mortgage policies enacted to spur demand for properties.

An example would be the relaxation of the Loan to Value (LTV) ratio for property loans by the Bank of Indonesia. The threshold was increased to a maximum of 85%, meaning that the required down payment for properties under a first- home ownership will only be 15% of the price, from the previous 20%.

While the impact has not been directly translated into improving sales, the tax amnesty programme, which ended in the first quarter, is also expected to gradually attract more onshore investment as a result of asset repatriation and disclosure.

Foreign developers’ expansion

Statistics from Indonesia’s Investment Coordinating Board in December 2016 showed that FDI in property rose from USD1.48 billion in 2015 to USD1.67 billion last year. In the same period, the number of projects backed by foreign investors also rose significantly, by 34%, to reach over 842 investors.

A typical partnership between foreign developers and lndonesian players is a Joint Venture partnership which involves funding commitment from the overseas investors. A recent example is Aerium, a project in West Jakarta. This project is the outcome of a partnership between the Itochu and Shimizu Corporation of Japan with a major local developer, Sinarmas Land.

Many other developers have chosen to work independently. China Communications Construction Group (CCCG), for example, is now overseeing the construction of its own project in West Jakarta, Daan Mogot City.

Outlook

In terms of grading, the upper-middle grade is projected to continue its popularity and experience stronger price growth relative to the others. This trend is brought about by the growing middle class population that has become increasingly affluent and interested in investing into properties that are worth the price.

Savills expects several buyers and investors to take a wait-and-see stance given the potential political and social tensions which may affect the property market.

Click here to download the Savills Asian Cities Report Jakarta Residential 2017 2H Report

To discuss the report or the Jakarta market email Craig Williams via the contact details below.

Similar to this:

2016 stimulating measures have not improved home buyer's take-up rate in Jakarta - Colliers

Strong fundamentals in the Jakarta residential market

Jakarta’s luxury housing market sluggish while demand increases for smaller units