Retail landscape in Jakarta evolving - Savills reports

Contact

Retail landscape in Jakarta evolving - Savills reports

Jakarta offers greatest retail supply in all Indonesia according to Savills Asian Cities Report - Jakarta Retail 1H 2018.

Indonesia's largest economic powerhouse is Jakarta. Priding itself on being the nation's main commercial, political and business hub Jakarta maintains a GDP growth rate similar to and oftentimes exceeding Indonesia's. Its annual GRDP growth rate for FY2017 stood at 6.22%, outperforming Indonesia’s which stood at 5.07%. Jakarta’s consumer confidence index in February 2018 also improved to 126.7, compared with 124.0 in February 2017. Infrastructure development and a conducive business and investment climate all contributed to the city’s economic growth. The role of supply in this economic growth is evident as Jakarta houses the most shopping centres in Indonesia with a rental shopping mall space totalling 3.1 million square metres as at the end of 2017.

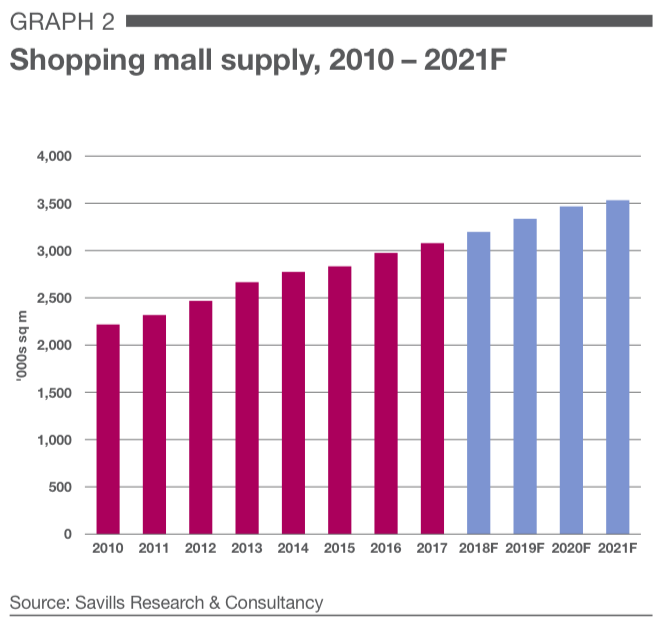

Since the 1970s, Jakarta's number of shopping centres has continued to increase, despite growth slowing due to permit securing complexities. Demand for retail space in Jakarta reached its peak between 2010 and 2013 where net take-up surpassed new supply. Since 2014, the pattern has reversed. In response to rising vacancies and a slow retail market, rents in Jakarta decreased slightly. Average rent reduced by 3% from last year’s average. The survival of the retail market depends on its consumers and retailers need to identify and adapt to customer preferences. Around 450,000sq.m. of new supply will enter the retail market between 2018 and 2021.

Source: Savills Asian Cities Report - Jakarta Retail 1H 2018

Supply

Aside from being Indonesia’s biggest business centre, Jakarta also houses the most shopping centres in Indonesia. The development of shopping centres in Jakarta began in the 1970s. Since then, the number of shopping centres has continued to increase, however, growth has slowed in the past few years due to the complexities involved in securing new permits as well as land scarcity in prime areas.

New supply in 2017 amounted to 103,500sq.m. – only about 73% of the new supply on offer in 2016. With this addition, total rental shopping mall space in Jakarta stood at almost 3.1 million square metres by December 2017.

In terms of grade, shopping centres in Jakarta can be classified into four grades: high-end, upper, middle-up and middle-low. Of the existing supply, currently 41% is middle-up, 32% is upper grade, 14% is high-end and another 13% is classified as middle-low mall.

Regarding location, South Jakarta offers the largest supply – accounting for about 37% of total supply. Meanwhile, North Jakarta, West Jakarta and Central Jakarta contribute around 21%, 19% and 15% respectively. East Jakarta, which has been developing lately, represents approximately 8% of the existing supply.

Based on Savills’ observation, the retail landscape in Jakarta is evolving; from simple, single-use structures to complex, mixed-use buildings. These days, many shopping centres are adopting new concepts to match consumers’ preferences – prioritizing experiential and entertainment aspects.

Click here to view Savills Asian Cities Report Jakarta Retail 1H 2018.

For more information or to discuss the report email Craig Williams via the contact details listed below.

Similar to this:

Smaller, cheaper units reported strongest sales in Jakarta's high rise residential market

Indonesia's medical tourism set to improve healthcare for locals and attract visitors