Where does Jakarta rank in the top locations in Asia for finance occupiers?

Contact

Where does Jakarta rank in the top locations in Asia for finance occupiers?

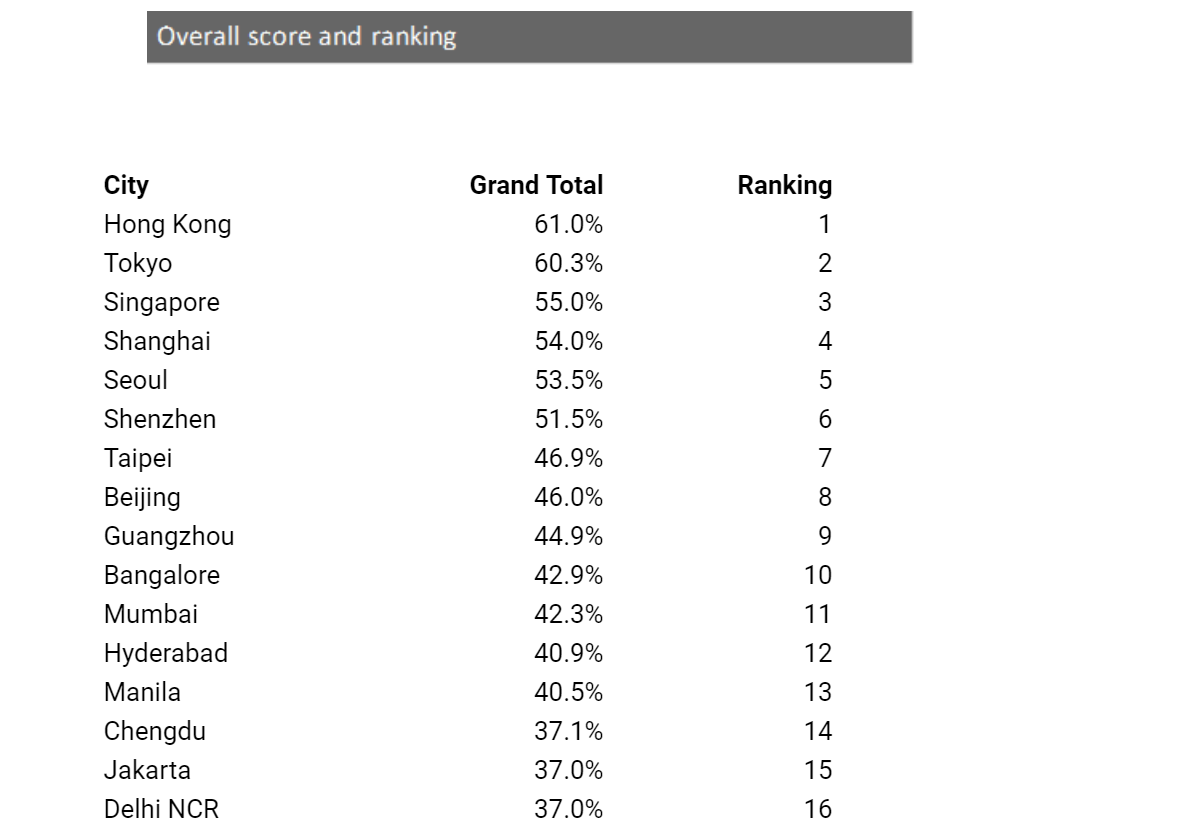

Colliers International have released its latest research report: Top Locations in Asia: Finance which examines nearly 60 criteria to determine the best locations in Asia for Finance sector occupiers.

Colliers International, today released its latest research report Top Locations in Asia: Finance. The report, based on a comprehensive study of 16 cities in developed and emerging markets across Asia, examines nearly 60 criteria across a spectrum of socio-economic, property and human factors to determine the best locations in Asia for Finance sector occupiers. This is the second report in our Top Locations in Asia series, following Technology.

At a glance:

- Research based on 60 criteria across socio-economic, property and human factors

- Hong Kong, Tokyo & Singapore top the list as best finance locations in Asia

- Jakarta ranks #15 which is the second lowest after Delhi, but as one of the emerging market cities in Asia, it is the most important financial centre in Indonesia.

- 16 cities in developed and emerging markets examined

- Shanghai at #4, benefiting the most from China’s financial liberalisation

- Seoul at #5, showing higher than expected score

Click here to view profiles of Leading Office Buildings in Jakarta with available office space

Andrew Haskins, Colliers’ Asia Head of Research, commented: “Based on quantitative and qualitative analysis of socio-economic, property and human factors, Colliers believes the three top locations in Asia for financial occupiers are Hong Kong, Tokyo and Singapore. At #4, Shanghai is benefiting the most among Chinese cities from the country’s financial liberalisation, while Seoul at #5 is a wild card finance location with strong scores.”

Colliers’ Indonesia Head of Research, Ferry Salanto, stated: “The financial occupiers have underpinned the commercial property in Jakarta which include sub sectors like banking, insurance and other financial-related companies. However, as an emerging market, Indonesia is still unmatched by any other developed markets. Jakarta property market is now waiting for a momentum for recovery at least after a few months post the election. We have also seen that fintech companies start expanding in looking for office space.”

Top Locations for Finance Firms

Hong Kong (Score: 61%; Position: #1) scores highly on socio-economic factors, including employment criteria such as political stability, ease of doing business and regulatory governance, and wealth factors such as stock market value, city inward FDI and position in cross-border banking. Under property factors, high wages and rents push up employer costs, but total office stock is high and there is a wide gap in rents between the CBD and other areas. Hong Kong is #2 in Asia on human factors, due partly to a low tax rate and high quality of living.

Tokyo (Score: 60%; Position: #2) comes in second place since it scores highest overall on socio-economic factors, reflecting its huge size, high wealth and stability as a global financial hub. The city’s high socio-economic score is partly offset by its low property score -- reflecting high staff costs, rents and a conservative office facility offering. However, Tokyo scores well on human factors, due largely to its high quality of living, safety, climate and lack of pollution.

Singapore (Score: 55%; Position: #3) scores very highly on socio-economic factors, especially employment criteria, due to high political stability, the ease of doing business, high-quality infrastructure and strong regulatory governance. It lacks the banking scale of Tokyo or Hong Kong but is a key wealth management centre. Singapore only has a modest score on property factors, due largely to its limited stock of prime grade office space. However, Singapore comes top on human factors such as personal tax, safety, living quality, climate and pollution, and the high-tech city metric included in our scoring.

Jakarta

(Score: 37%; Position: #15) Jakarta’s financial market will continue to opt the CBD area as the preferred location as it has been the heart of financial centre in Indonesia.

Alternative Finance Location

Shanghai (Score: 54%; Position: #4) is China’s financial capital. It scores well on measures of economic scale and wealth, with GDP/capita 139% of the national average and an equity market value of about USD4.2 trillion. Shanghai also scores highly on property factors, notably on quality of office stock, and on intra-city connectivity. It has two key financial zones (Lujiazui and the Bund) and is benefiting the most among Chinese cities from the country’s financial liberalisation.

Wild Card Location

Seoul (Score: 53.5%; Position: #5) scores favourably on measures of economic scale and wealth, as well as employment considerations such as political stability, ease of doing business and city infrastructure. While Seoul’s ranking on property factors is modest, it scores highly on human factors such as safety, environment and the high-tech city metric.

Source: Colliers International

Similar to this:

View profiles of Leading Office Buildings in Jakarta with available office space

Infrastructure development to improve logistics performance

The first of its kind? - office building with private concierge in Jakarta