Opportunity for new foreign capital to enter Indonesia during COVID-19 - Colliers

Contact

Opportunity for new foreign capital to enter Indonesia during COVID-19 - Colliers

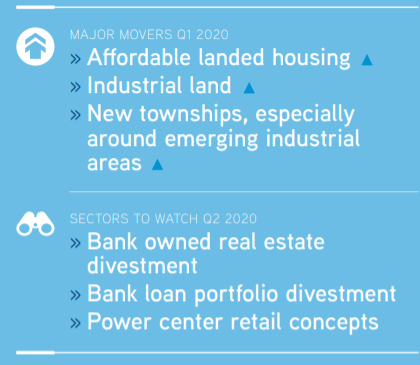

Colliers has released its Asia Pacific Market Snapshot for the first quarter of 2020, detailing the impact of COVID-19 across all sectors of Indonesia's property market.

The financial impact of COVID-19 on Indonesia could represent a significant discount-buying opportunity for new, foreign capital entering the market, Colliers International says.

According to the Indonesia Hotel and Restaurant Association (PHRI), occupancy rates dropped to as low as 20 per cent for many of Bali’s hotels and resorts while the country’s overall occupancy rate fell to between 30 per cent and 40 per cent, which is below the low-season average of 50 per cent- 60 per cent, since the virus outbreak in late December.

According to Colliers' Asia Pacific Market Snapshot Q1 2020, if local property sellers haven’t adjusted their asking price in rupiah, new investors could avail of "significantly discounted prices" based on the currency’s depreciation alone.

Source: Colliers International

According to Colliers Director for Indonesia Capital Markets, Steve Atherton, demand for office and retail space is also dropping with Jakarta declaring a state of emergency in the capital and ordering offices to close and employees to work from home.

"Many firms may also find it difficult to pay rent as businesses suffer a dramatic decline in turnover, and due to physical distancing rules and travel restrictions," the report said.

"The residential property market will also be heavily impacted as workers face layoffs, which may force many property owners (and tenants) to default on their mortgage or rental payments.

"As negative sentiment pervades the market, property developers will also mostly likely delay new investments."

Click here to download the report.

Similar to this:

International visitor arrivals to Indonesia to drop by 38 per cent in 2020 - Ross Woods, HIS

International investors to remain 'extremely active' in Indonesia - JLL